|

January 21, 2016

Do Customers Understand Their Power Bill? Do They Care? What Utilities Need to Know

Bill LeBlanc

The power bill has been part of the American budget and psyche for the past century, with electricity bringing great benefits to households while also producing anxiety or even dread when that monthly bill hits the mailbox or inbox. E Source recently completed a detailed North American market research study on customer attitudes and actions around electric pricing, bills, home automation, battery storage, electric vehicles, and solar rates and incentives. The results are more stark and distressing in some ways than they are surprising. It seems that when utility customers read their energy bill, many of them don’t understand what they’re buying or how they’re being charged, but it’s certainly not because they don’t care.

Anybody who’s attended a consumer-oriented energy conference in the past four years has heard that “the average consumer spends only nine minutes per year thinking about energy.” This oft-repeated data point (or some version of it) is a misquote from a 2010 Accenture study (PDF) that says, “[M]ost [consumers] only interact with their provider an average of nine minutes per year” (p. 8). The quote implies that customers don’t engage with, or even care about, their energy use or their bill. To get fresh insights on this important issue, we decided to ask pointed questions in our recent survey of 3,000 North American residential utility bill payers.

Do Customers Read and Understand Their Energy Bill?

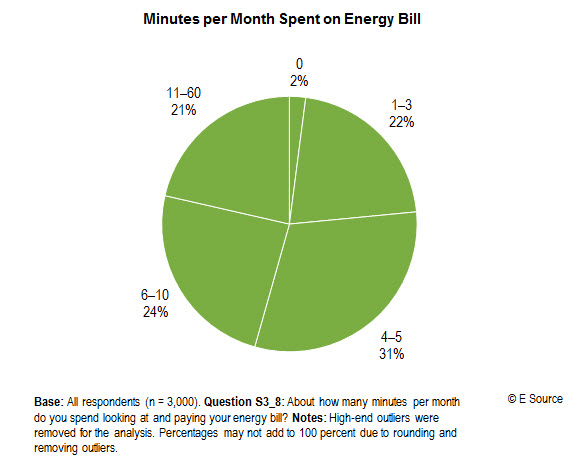

First, we asked about the amount of time respondents spent “looking at and paying your electricity bill.” The average was 114 minutes per year, while the median was 60 minutes per year. This is an order of magnitude higher than conventional wisdom and clearly indicates that customers do in fact care about their utility bill.

We also dug into how much time they spent “thinking about and studying issues regarding your home’s energy use.” The average amount of time was 5.5 hours per year, while the median was 2.0 hours per year. So although home energy usage may not be as top of mind as Kim Kardashian, fantasy football, or who’s going to make Madison’s costume for the school play, residential customers do spend a meaningful amount of time contemplating their home’s energy use.

These results tie to two additional key questions we explored: Do customers understand their bills and how they are charged, and do they care? Interestingly, customers indicated a fairly low level of understanding of their bill and the way they’re charged for electricity. But they demonstrate a high level of interest in understanding these things better. Our research found that only 17 percent of customers feel that they have a very good understanding of their bill, whereas 30 percent think they have a poor understanding. When asked a follow-up question about whether understanding their bill and rate structure mattered, respondents largely (83 percent) said it was very or somewhat important to them. The self-identified “environmentally oriented” customer segment had both the highest stated understanding of their bill and energy usage and the greatest interest in learning more. The “convenience-oriented” segment scored the lowest on both attributes. Age was also an important factor, with millennials caring more about learning about their energy usage than their aged-55-and-over counterparts.

Do Customers Know What the Bill Is Telling Them?

We also asked customers about their understanding of the terms they see on their utility bill. About half of the customers said they understood the terms kW and kWh; the other half were only somewhat or not very familiar with these basic building blocks of the utility bill. When we introduced common utility terms such as demand and load shape, customers were flummoxed.

The terminology that utilities use in bills and communications about rate and pricing options has an important impact on customer perceptions and decisions. For example, we asked about customers’ emotional reaction to 24 terms commonly used in describing rates, pricing, and other product options. Energy efficiency, reliability, and solar scored strong positives, with an absence of negative emotions, meaning that most customers responded positively to these terms. On the other end of the spectrum, the terms demand charge, surcharge, and tariff elicited mostly negative reactions from large portions of the population.

Filling the Knowledge Gap

There’s a clear knowledge gap and an opportunity for utilities to educate customers on how they’re charged for energy and what their bill is telling them. What if utilities took the time to educate customers about energy terminology and how they’re billed for energy usage? Would it make a difference in how customers feel about their bills and the communications they receive from their utility? We think yes. Consider this interesting finding from our survey: Customers who said they receive a home energy report comparing their energy use with their neighbors’ always showed a higher positive score for each term tested.

Utilities will need to discover many more ways to engage their customers, as there is a long road ahead in transitioning rates from the old world to the new world. Customers will discover that understanding pricing becomes even more important as they adopt new technologies to better manage their bills. To help utilities navigate these treacherous waters, the E Source study Innovative Residential Rate Design and Pricing: Customer Preferences and Acceptance provides deep insights into not only customer understanding of bills, but also the future interaction of pricing with solar, smart lighting, smart thermostats, home batteries, and even electric vehicles. This data can be used to recognize how various customer segments need to be treated differently, where customers are more or less likely to find benefits or create resistance, and how utilities can develop rationales for their management and regulators for substantial rates and pricing design changes.

To learn more about the market research study behind these results, watch the archived web conference.

|