Ford, whose revenues are forecast to grow slowly (5.21% per year), recently unveiled its all-electric 2022 Ford F-150 Lightning, marking a new chapter in electric vehicle (EV) model announcements, which have been flooding in over the past couple of years.

But will the truck be popular? Whether consumers embrace it probably won’t depend on its torque, towing ability, or even its substantial range per charge. Instead, its popularity will likely depend on the personalities of truck buyers.

Will pickup drivers make the switch to all-electric?

The answer is a resounding yes for the 70,000 people who put down a deposit for a Lightning in the first few days after the announcement. But Ford has been selling an average of about 900,000 F-150s per year, according to the Autoweek article Ford Averages over 100 F-150 Pickups Sold per Hour, 24/7. Can those pickup owners see themselves behind the wheel of an EV? Will they see charging as a benefit or a chore? Will it fit in with their social group and norms?

We looked at the data from the 2020 E Source Electric Vehicle Residential Customer Survey to see if we could tease out some answers. Overall, about 12% of respondents reported currently owning a light-duty pickup (the category the F-150 falls into), and another 6% say they have a heavy-duty truck. In comparison, 41% have an SUV or crossover, and 51% have a small or midsize hatchback or sedan. For new sales, according to the Car and Driver article People Still Buying Lots of SUVs and Crossovers, Sales Numbers Show crossovers are accounting for an increasing share of the market. So trucks are a decent market for EVs, but not necessarily in the game-changer category like an all-wheel-drive crossover would be.

Our research notes that truck owners are considering an all-electric purchase at overall lower rates than nontruck owners, but it’s not a huge difference—28% versus 20%. When we asked respondents interested in EVs about the types of interactions they’ve had with EVs, the results were mixed between truck versus nontruck owners. Truck owners were somewhat more apt to have searched online about an EV (39% versus 34%), watched an advertisement about EVs (38% versus 30%), or read a news article about EVs (30% versus 24%). Truck owners were slightly less likely to have attended an event about EVs or spoken to a salesperson about EVs. Of course, we don’t know whether these latter differences were related to lack of interest or lack of EV availability in their area. Overall, it appears that truck owners are fairly aligned with nontruck owners in their overall interest in EVs. That’s great news!

What type of EV will consumers purchase?

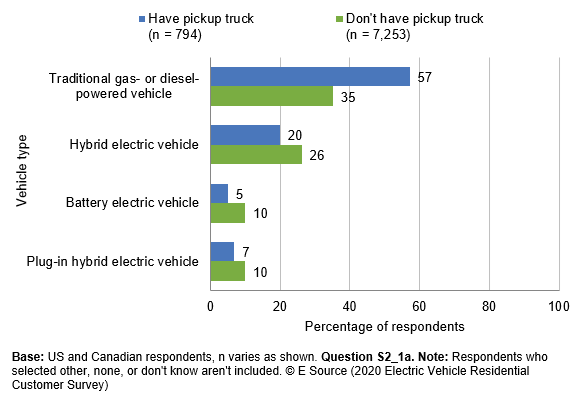

When we investigated what type of vehicle respondents would next purchase or lease, the differences became more pronounced. When given the choice of an all-electric vehicle (also known as a battery electric vehicle or BEV), plug-in hybrid electric vehicle (PHEV), traditional hybrid (no plug-in capability), or traditional internal combustion engine (ICE) vehicle, 57% of truck owners said they would choose an ICE vehicle; 35% of nontruck owners said the same thing. And 20% of nontruck owners said they plan for their next vehicle to be a BEV or PHEV, while only 12% of truck owners indicated that choice (figure 1). This lack of desire may stem from the fact that the truck drivers knew there were no good models available to them at the time of the survey in 2020, although our research points out an overall lack of knowledge about EVs in the general population. Among those who aren’t considering an EV, 20% of truck drivers cited the lack of available models as a key barrier compared to 9% of nontruck drivers. And they cited lack of public charging stations and fear of running out of power more often than nontruck drivers. The Ford F-150 Lightning, along with announced plans for trucks by Rivian and Tesla, may change the way this group views the truck category.

Figure 1: Anticipated next vehicle purchase

As we dive further into the barriers to EV adoption, we find more similarities than differences between truck and nontruck drivers. Among those respondents who said they’re considering an EV, barriers such as performance uncertainty, maintenance concerns, charging insecurity, and familiarity all scored fairly evenly. The areas we do see statistical differences are related to their feeling about the cost being too high (49% of truck drivers versus 39% of nontruck drivers), the fact that EV technology is changing so fast they fear their vehicle will be outdated quickly (31% versus 24%), range concerns (41% versus 35%), and lack of public charging stations (25% vs 18%). While these cumulatively add up to higher barriers among the “considering an EV” group, they’re certainly not insurmountable with additional education and outreach. Information about charging efficiently, reliably, and inexpensively at home is likely to resonate.

What’s next for all-electric pickup adoption?

Our recommendations for accelerating EV sales among truck enthusiasts are consistent with our recommendations for all drivers:

- Assist potential buyers by helping them understand how to charge, with major emphasis on home charging versus public charging

- Highlight tax credits and other monetary savings that can help overcome first-cost concerns

- Find the segment of truck drivers who are most apt to be early adopters and focus on marketing to them, as opposed to trying to overcome all the barriers with the late adopters in the first years

- Focus on lifestyles for these top segments, showing truck drivers who are succeeding with EVs, using local case stories whenever possible

- Become an advocate for electric transportation by partnering with your customers, dealers, and other EV-interested groups to support the entire EV transition in your service territory