When it comes to increasing the adoption of residential electrification technologies, there are a couple things utilities can do to be successful. There is nothing more important than identifying the right customer segments to target. Get that right and you’ve got a solid foundation for your marketing plan. It’s also important to use messaging that will resonate with your target audiences. For example, using messaging that addresses customers’ motivations for and barriers to purchasing each technology will help them warm up to the idea of electrification.

To help you with your marketing efforts, we’ve outlined those barriers to and motivations for purchasing electrification technologies using insights from the E Source 2021 Residential Electrification Survey.

The customers most likely to buy electrification technologies

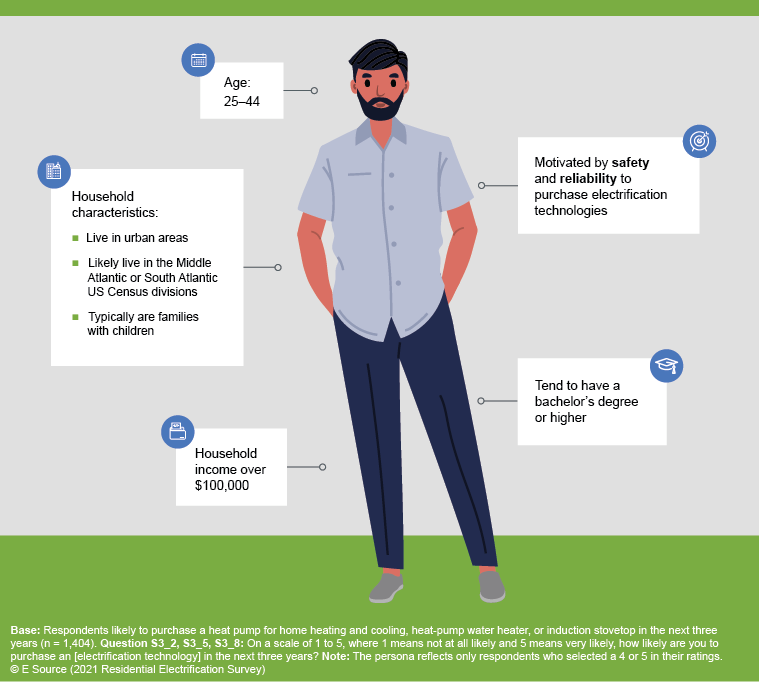

We found that respondents who are likely to purchase heat pumps, heat-pump water heaters (HPWHs), and induction cooktops share similar characteristics. So we developed a customer persona based on those characteristics (figure 1). These respondents:

- Live in urban areas in the Middle Atlantic or South Atlantic US Census divisions

- Are typically families with children and make over $100,000 annually in household income

- Are motivated by safety and reliability to purchase electrification technologies

Figure 1: Characteristics of respondents who are likely to purchase a heat pump, HPWH, or induction cooktop

How to market electrification technologies

From our survey, we found that respondents who said they were likely to purchase an electrification technology were most motivated by safety and reliability. We also identified barriers to purchase among respondents who said they were unlikely to buy an electrification technology in the next three years. Satisfaction with their current system was a top barrier to purchase. Respondents were also concerned with the hassle and costs associated with changing systems. For example, let’s dive into the survey results about heat pumps.

Motivations. When considering purchasing a heat pump, respondents said they were most motivated by:

- Safety (45%)

- Reliability (42%)

- Air quality improvements (39%)

Barriers. Alternatively, those who aren’t planning to purchase heat pumps named the following as their top barriers:

- Satisfaction with current system (46%)

- Concerns about purchase and maintenance costs (40%)

- Hassle of changing their current system (37%)

Likelihood to recommend. Among respondents who have a heat pump for home heating and cooling, just over 75% said they were likely to recommend the technology. (We asked respondents to rate their likelihood to recommend on a 10-point scale, where 10 meant very likely. We consider a rating of 7 or above as likely to recommend.) Consider using customer testimonials about the benefits of heat pumps in your marketing and messaging.

Besides the cost savings and greater efficiencies, other reasons respondents like heat pumps are that they:

- Keep their homes comfortable

- Are easy to use and maintain

- Provide heating and cooling

- Are reliable

Messaging. When marketing its heat-pump program, Energy Wise Minnesota (MN) uses messaging to highlight available rebates and the heating and cooling benefits that air-source heat pumps provide (figure 2). On its website, Energy Wise MN leads with the fact that customers can get up to $2,000 and use 72% less electricity with an air-source heat pump.